Bridging the Gender Gap in Entrepreneurship: Financing Models to Scale Women-led Enterprises in Northern Nigeria

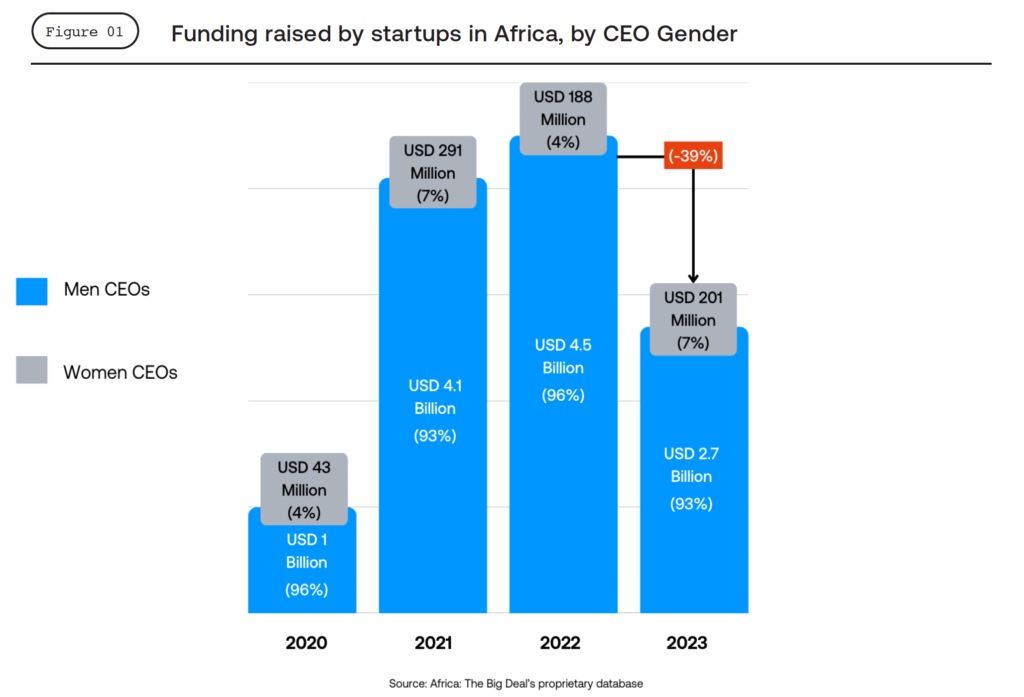

Women across Africa consistently receive significantly less funding than their male counterparts. According to Africa: The Big Deal, in 2023, women-led ventures in Africa raised just above $200 million.

Women across Africa consistently receive significantly less funding than their male counterparts. According to Africa: The Big Deal, in 2023, women-led ventures in Africa raised just above $200 million.

This reflects a commendable year-on-year growth of 7% considering that overall funding in Africa shrank by 39% during the same period. However, in absolute terms, the disparity remains staggering—male-led ventures raised $2.7 billion, 13 times greater than their women-led counterparts.

The funding landscape in Nigeria

In 2023, Nigeria maintained its leading position in venture capital deal activity across African countries for the third year, capturing 19% of the total deal volume, according to the African Private Capital Association. Despite this, the capital inflows are unevenly distributed, with Lagos and Abuja securing the lion’s share due to their more developed infrastructure, robust business ecosystems, and proximity to investor networks. In contrast, Northern states have significantly lagged, with pronounced funding gaps driven by historically low development indicators that have disincentivized investment in formal and informal startup ecosystems. As a result, Northern Nigerian women entrepreneurs face a dual burden of financial insecurity and systemic neglect.

Despite these challenges, women in Northern Nigeria are increasingly turning to entrepreneurship as a form of empowerment to redefine traditional roles and assert economic agency. However, access to critical resources like capital, skills, market, mentorship, and professional networks remains fragmented and often inaccessible. The structural barriers and gender biases amplify the difficulties they face.

In line with a mission to unlock capital in global underserved markets, CrossBoundary partnered with TTLABS, Startup Kano and the Northern Founders Community to convene a roundtable focused on garnering insights from women operating in Micro, Small, and Medium Enterprises (MSMEs) to address finance linked gender-nuanced challenges for female entrepreneurs in Northern Nigeria.

Download the “Bridging the Gender Gap in Entrepreneurship: Financing Models to Scale Women-led Enterprises in Northern Nigeria” report for insights from the event including key challenges restricting women’s agency and access to resources (primarily capital) in Northern Nigeria and inclusive financing solutions that are helping to overcome these barriers.