Sub-Saharan Africa

About Us

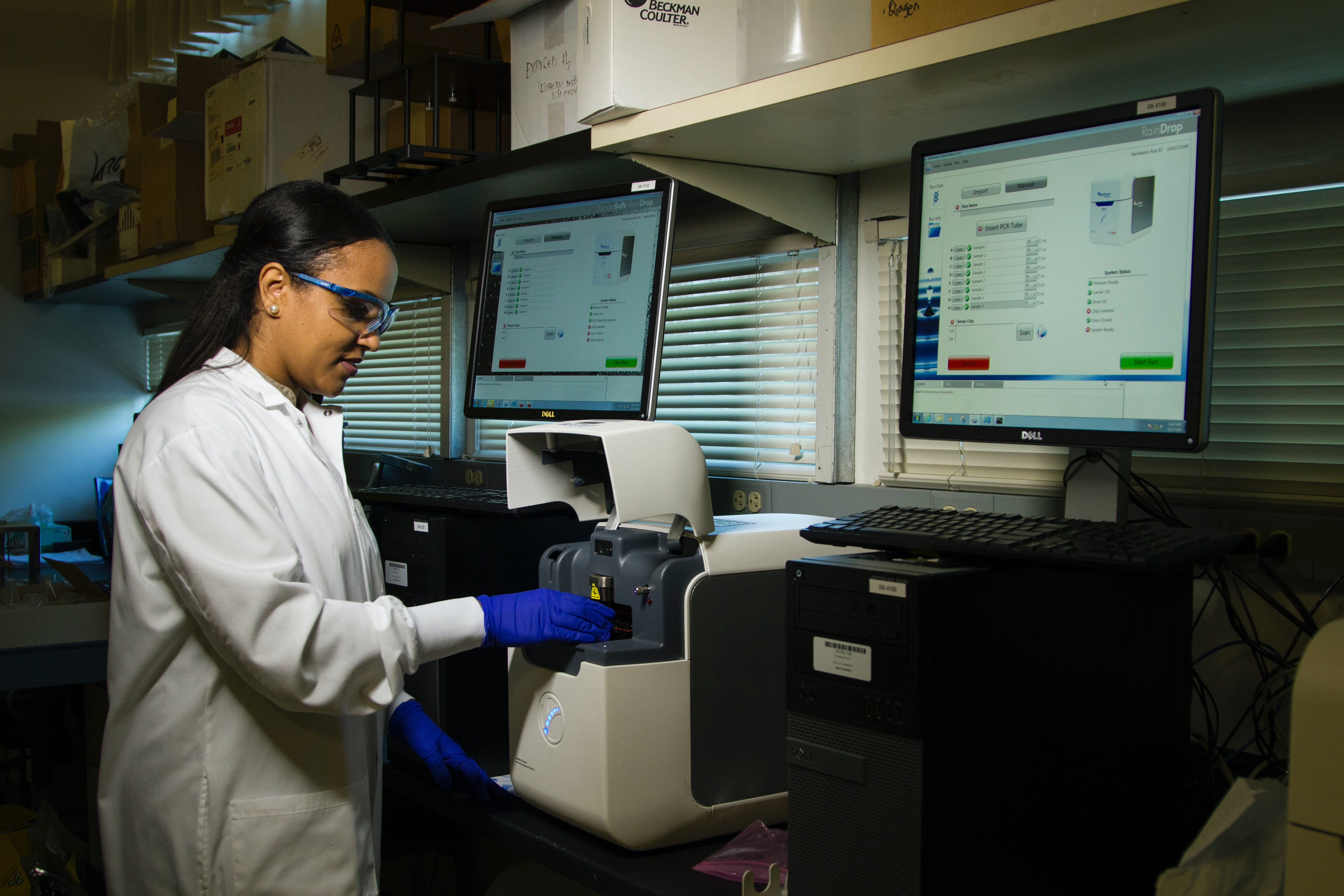

Our work embraces the dynamic between foreign investment and local development to unlock private capital and drive sustainable growth in Sub-Saharan Africa

With 160+ investment professionals across 8+ offices and a track record of more than 10 years in the continent, our team has a deep understanding of African markets.

Our range of clients includes indigenous and foreign-owned companies, financial institutions, and governments.

To date, we have advised on over US$8B in transactions across sectors including energy and infrastructure, agriculture and agri-business, manufacturing, financial services, healthcare, real estate, and more.

Africa: The world’s next growth market

By 2050, Africa will be home to 2.5B people, a quarter of the world’s population

Africa’s vast trade and Investment potential and expanding continental integration (AfcFTA) primes the continent to be a significant player in the global economy

CrossBoundary has been committed to Africa’s growth story since our founding in 2011; we’ve ridden the headwinds and tailwinds and will continue to deliver impact on the continent because we authentically care

We intend to continue crafting investable opportunities on the continent to enable relevant stakeholders to capture the value from Africa’s growth

By 2050, Africa will be home to 2.5B people, a quarter of the world’s population

Africa’s vast trade and Investment potential and expanding continental integration (AfcFTA) primes the continent to be a significant player in the global economy

CrossBoundary has been committed to Africa’s growth story since our founding in 2011; we’ve ridden the headwinds and tailwinds and will continue to deliver impact on the continent because we authentically care

We intend to continue crafting investable opportunities on the continent to enable relevant stakeholders to capture the value from Africa’s growth

Capabilities

We provide our clients with the expertise they need to ensure the best outcomes

Capabilities

Strategy Advisory

Navigating market complexities to support a variety of capital providers and policymakers

Sovereign Advisory

Providing governments with strategic advice on how to attract private investments, while also facilitating public-private partnerships

Deal Structuring

Navigate the structuring and negotiation process to achieve both short- and long-term objectives

Opportunity Validation

Zero in on high-ROI investment targets across multiple sectors, evaluating their commercial viability, and aligning with fundraising and strategic needs

Capital Raising

Streamlining the capital acquisition process, effectively linking projects with both domestic and international investors

Fund Design and Strategy

Designing financial vehicles tailored to your sector, maximizing both financial returns and social impact

Market Access & Assessment

Dissecting markets to provide actionable insights into local trends, competitive landscapes, and regulatory environments

Due Diligence

Our rigorous vetting process includes financial feasibility studies and real-time data on regulatory climates, fortifying your investment decisions

Fundraising Support

From equity to debt and even niche products like political risk insurance, we source the right types of capital from investors who align with your needs

Post-Investment Planning

Post-acquisition, charting a path to growth through business development strategies, operational improvements, and cost-saving measures

Blended Finance

Engineering finance structures that combine public and private funds, reducing investment risks without diluting returns

Financial Analysis

In-depth financial feasibility studies, valuations, and FX risk analyses to guide investment choices

Procurement Advisory

With a deep understanding of market dynamics, we help clients achieve specific procurement objectives efficiently and cost-effectively

Engagements

-

CrossBoundary AdvisoryEthiopia

CrossBoundary AdvisoryEthiopiaBusiness Valuation Support for Pan-African Medical Equipment Distributor

Read More -

CrossBoundary AdvisoryDemocratic Republic of Congo

CrossBoundary AdvisoryDemocratic Republic of CongoCapital Raise for a Pioneering Coffee & Cocoa Cooperative in DRC

Read More -

CrossBoundary AdvisoryBurkina Faso

CrossBoundary AdvisoryBurkina FasoSupport to the Design of the West Africa Bright Future Fund

Read More

Insights

-

CrossBoundary Advisory22.12.2022Blog

CrossBoundary Advisory22.12.2022BlogAn Eye Towards Scaling Inclusive Optical Retail in Africa

Read on MediumRead on Medium -

CrossBoundary Advisory18.10.2023Blog

CrossBoundary Advisory18.10.2023BlogCrossBoundary Attends the Nigeria Energy Leadership Summit

-

CrossBoundary Group05.12.2013Publication

CrossBoundary Group05.12.2013PublicationInvestment Facilitation in Transitional and Fragile States

Our Team

Our Team