Bridging Continents Workshop at COP30: Scaling Mini-Grid Solutions from Africa to the Americas

Summary

The Bridging Continents Workshop, hosted by CrossBoundary and the Africa Minigrid Developers Association (AMDA), at the TED Countdown House in Belem, brought together mini-grid developers, operators, financiers, DFIs, private-sector energy companies, and ecosystem enablers from Sub-Saharan Africa (SSA) and Latin America & the Caribbean (LAC) to exchange practical lessons that can accelerate mini-grid deployment across both regions. With climate ambition now needing to translate into real, investable projects, the session highlighted concrete actions and shared solutions that can move faster than policy agreements alone.

Electrifying Africa through mini-grids is estimated to cost USD$91 billion, with 500 million people still lacking electricity access. In LAC, it is estimated that over 16 million people remain unelectrified, including up to 1 million in the Brazilian Amazon alone. Mini-grids remain the least-cost solution for many of these communities, and declining PV and storage costs, coupled with modular technologies, are strengthening their economics. SSA developers bring deep experience in productive-use stimulation, standardized procurement, and data-driven operations, while LAC developers have built models that address extremely remote communities, rapid deployment, and integration with social programs.

Both regions, however, face similar challenges, particularly financing gaps, high logistics costs, FX and local currency mismatch, and subsidy designs that do not fully support scale.

Two panel discussions surfaced key insights across both regions. The panel on developer lessons highlighted the importance of driving demand through productive-use activities, securing anchor customers, building project portfolios, and leveraging government pre-development support. Developers also stressed the value of digital tools for predictive maintenance and the need for strong partnerships with cooperatives, fintechs, financiers, and government agencies to enable scale.

The finance and policy insights panel emphasized that smaller developers face significant barriers to accessing capital due to high due diligence costs and investor preferences for large-scale assets. Panelists pointed to community-led models, better national data systems tracking communities, results-based financing, and greater accountability from DFIs as key enablers for unlocking and deploying capital more effectively.

Breakout sessions explored the technical and financial levers needed for scale. On the technical side, participants highlighted demand–supply simulation, decentralized models, predictive maintenance and climate-resilient infrastructure. On the finance side, discussions focused on aligning financing with demand growth, expanding consumer and Productive Use Energy financing, enhancing early community engagement, and testing out blended finance structures that can de-risk mini-grid projects.

Several cross-cutting insights emerged that both regions can adopt now:

- Stronger developer–financier alignment across the project cycle

- Demand stimulation as a core strategy

- Structured community engagement and co-design

- Portfolio-based approaches to spread risk and attract capital

- Innovative financing models such as blended finance, community benefit funds, concessional funding and Results-Based Financing

- Climate-resilient system design for remote and vulnerable areas

Looking ahead, funders and DFIs can play a catalytic role by deploying capital tailored to developer needs, improving transparency around their disbursement targets, and promoting innovative financing structures that lower the cost of capital and increase private sector participation. The discussions also highlighted the importance of continuing the Bridging Continents dialogues to strengthen collaboration between SSA and LAC, with AMDA expressing eagerness to help take this forward. Overall, the workshop demonstrated that practical collaboration between developers and financiers, combined with the right technical and financial innovations, can accelerate reliable, affordable, and scalable mini-grid deployment across both regions.

Objectives and why this mattered at COP30

This workshop aimed to enable cross-regional exchange of mini-grid best practices to support faster scale-up in both LAC and SSA. The session focused on what collaboration and action look like in practice, highlighting approaches from both regions and sharing lessons from Sub-Saharan African developers with deeper experience operating mini-grids at scale. At COP30, this discussion matters because the world is at a tipping point where climate ambitions must become investable, on-the-ground reality. The exchange supported practical progress that can move faster than policy agreements alone by strengthening collaboration between developers and financiers and aligning the conditions needed for financing to flow faster.

Who joined?

The session brought together a diverse mix of sector leaders, including leading mini-grid developers and operators, financiers and DFIs, private-sector energy companies, and ecosystem enablers working across both LAC and SSA to create a rich environment for practical learning, honest discussion, and cross-regional collaboration.

Welcome and scene-setting

Electrifying Africa through mini-grids is estimated to cost USD 91 billion, yet half a billion people on the continent still lack access to electricity. In Latin America, around 16 million people remain unelectrified, including up to 1 million in the Brazilian Amazon. This persistent energy gap limits economic opportunity, constrains access to healthcare and education, and heightens climate vulnerabilities.

Mini-grids are the least-cost solution for many of these underserved communities, and their business economics continue to improve. With falling PV and battery storage costs, and the growing availability of modular, scalable systems, developers are able to deploy more efficiently and reliably. As a result, mini-grids generate benefits far beyond household lighting, unlocking jobs, boosting incomes, and supporting broader economic development for these communities.

Mini-grid developers in Sub-Saharan Africa bring deep experience from a longer track record in working with productive-use energy solutions, demand stimulation, standardized procurement, and data-driven portfolio management. In Latin America, developers often operate under different models, including Distribution Company (DISCO) led business models, fast technology deployment, integration with social programs and systems serving extremely isolated Amazonian communities.

But both regions face similar constraints: financing gaps, FX and local-currency mismatch, working-capital limitations, and subsidy designs that don’t fully support scale. To unlock the capital required for widespread electrification, developers and financiers from both regions need far closer collaboration, aligning their needs and expectations to get more projects to bankability and deployment.

Panel discussions

Panel 1: Developer lessons

Developers from Africa and LAC share lessons on building, operating, and scaling mini-grids in diverse and challenging contexts.

The developer panel highlighted that while mini-grid companies in both Africa and Latin America are driven by strong impact goals, they face similar constraints, including low customer ability to pay, complex regulatory environments, high logistics costs, and limited access to local financing. African developers often operate in contexts with large electrification gaps and low affordability, navigating national-grid–focused policies and high perceived risk from investors. Over time, they have developed strong capabilities in productive-use stimulation, standardized procurement, demand growth, and portfolio development, supported by blended finance, grants, and partnerships with community agriculture cooperatives and organizations like the Africa Minigrid Developers Association (AMDA).

LAC developers, particularly in the Amazon, face significant logistical barriers, with many communities reachable only by river and affected by seasonal access constraints. Complex tax systems, high interest rates, and the absence of sector-support organizations like AMDA further complicate project development. As a result, LAC developers prioritize decentralized systems, digital tracking of systems and strong community training to support system maintenance.

Across both regions, panelists noted that business models built around productive use and anchor customers are essential for raising demand and improving financial viability. Scaling requires portfolio-based approaches, better government pre-development support, and financing structures such as grants, RBF, and blended finance.

Recommendations for new developers entering either region include developing a deep understanding of the regulatory landscape, building strong partnerships with community groups and commercial off-takers, and adopting strategies like the Anchor–Business–Community (ABC) model. Looking ahead, developers expect innovations like interconnected and mesh-grid systems, improved demand-aggregation tools, predictive maintenance and climate-resilient infrastructure to play a central role in shaping the next generation of mini-grid projects.

Panel 2: Finance and policy enablers

Financial and policy experts share insights on improving access to capital and making investment structures more inclusive for mini-grid developers.

The finance panel emphasized that while there is strong interest in expanding mini-grid investment in both Africa and Latin America, small developers face major barriers. Larger investors often avoid smaller projects due to high due-diligence costs and a preference for large-scale assets, while many contracting and procurement processes are structured for large developers and remain inaccessible to smaller players.

The discussion highlighted the importance of community-led approaches, where communities are trained to operate systems due to their remote locations, manage productive-use activities, and generate additional income streams. In Brazil’s Amazon, productive-use initiatives, from seed oil production to cold storage for fishing, and online learning, are improving livelihoods, but logistics and high transport costs remain a major obstacle to delivering mini-grid systems in isolated communities. At the same time, Brazil’s well-organized data on indigenous communities shows how better national data systems can support stronger project design, something still needed in many African markets.

Across regions, panelists agreed that DFIs must be held more accountable for deploying capital as promised, and that financing structures need to be better tailored to the realities of small developers, who often lack the scale to create SPVs or secure major contracts.

Breakout sessions

The breakout sessions explored both the technical and financial levers needed to scale mini-grids in remote and underserved communities. Discussions covered system optimization, demand–supply forecasting, decentralized models, and long-term community needs, alongside financing approaches that match real demand growth, strengthen consumer and productive-use financing, and improve early-stage community engagement. Together, the groups identified practical actions that would make mini-grids more reliable, affordable, and investible across both regions.

Breakout Session 1: Mini-grid Optimization & Serving Isolated/Hard-to-Reach Communities

This discussion focused on strengthening system performance, improving demand–supply matching through demand simulation, exploring innovative decentralized system models, and designing solutions around long-term community needs.

- What can be replicated?

- Different mini-grid interconnection models

- Allied industry demand and PUE partnerships

- Predictive maintenance of mini-grid systems leveraging AI-supported optimization

- What we need to unlock it:

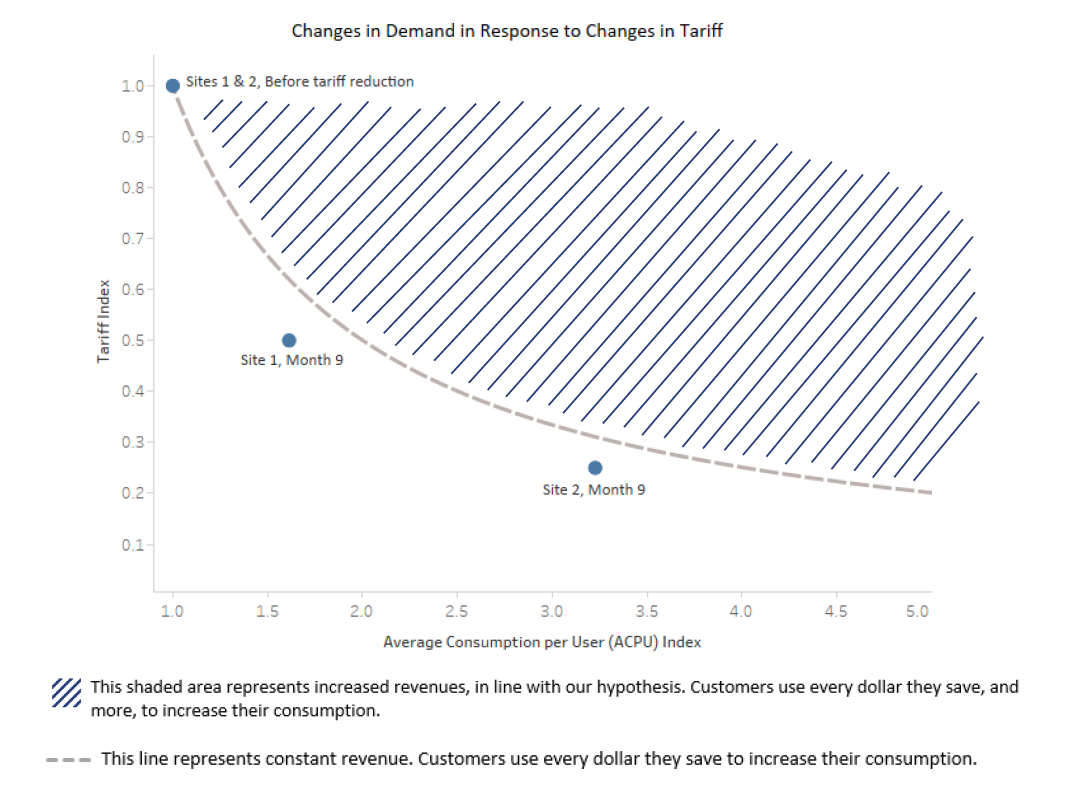

- Tariff balance between affordability and profitability

- Research innovation

Interactive breakout session exploring technical solutions for optimizing mini-grids and system design for remote and hard to reach communities.

Breakout Session 2: Structuring Mini-grid Finance

This discussion explored how to better align financing with demand growth, strengthen demand simulation, and expand consumer financing to support productive-use activities. The discussion also highlighted the need for early community engagement and innovative financial models that make mini-grids more affordable and investible.

- What can be replicated?

- Pricing the social and environmental impact of mini-grids to justify concessional financing

- Community engagement through feasibility workshops that help identify potential demand

- What we need to unlock it:

- Stronger alignment of partners with the right expertise at each stage of the project development cycle.

- Leveraging Distributed Renewable Energy Certificates (DRECs) and Peace Renewable Energy Credits (PRECs) as additional revenue streams, though market consolidation is still needed for reliable monetization.

- Exploring tokenization to bring in retail investors and diversify capital sources

Cross-cutting insights (what both regions can adopt now)

- Stronger developer–financier alignment: Developers and financiers need clearer engagement to come up with appropriate financing across the project cycle to unlock capital and reduce risk.

- Demand stimulation as a core strategy: Productive-use activities, appliance financing, and anchor-business models remain essential for raising load factors and improving project viability.

- Community engagement and co-design: Early, structured engagement helps identify real demand, strengthen willingness to pay from communities, and supports long-term system sustainability.

- Portfolio-based approaches: Bundling sites into larger portfolios makes projects more bankable, spreads risk and increases access to blended and concessional finance.

- Innovative financing models: Community benefit funds, alternative funding platforms to include retail investors, RBF, and blended finance structures can help fill gaps for smaller developers and low-income communities.

- Climate-resilient infrastructure: Both regions will benefit from designing mini-grids that withstand seasonal challenges, climate shocks, and logistics constraints.

Participants connect and exchange ideas during informal discussions at the Bridging Continents Workshop.

What funders and DFIs can do next

- Deploy capital that matches real developer needs, including early-stage equity, working capital, and local-currency debt that align with different points in the project lifecycle.

- Strengthen accountability and transparency by publishing metrics on commitments vs. actual disbursements and ensuring pledged capital reaches projects on the ground.

- Support portfolio-based financing, enabling smaller developers to bundle sites and reduce due diligence costs, making their pipelines more bankable.

- Back results-based financing (RBF) structures that reward verified connections, productive-use adoption, and long-term performance rather than just Capex.

- Promote innovative financing models such as community benefit funds or shared-ownership structures and emerging markets like PRECs, to lower the cost of capital and improve community buy-in.