Appliance Financing Innovation Insight – CrossBoundary Innovation Lab

Mini-grids are self-sufficient electricity grids that serve households and businesses isolated from or integrated with the main grid. CrossBoundary’s Mini-Grid Innovation Lab estimates they are the cheapest way to deliver power to at least 100 million people living off-grid in Africa.

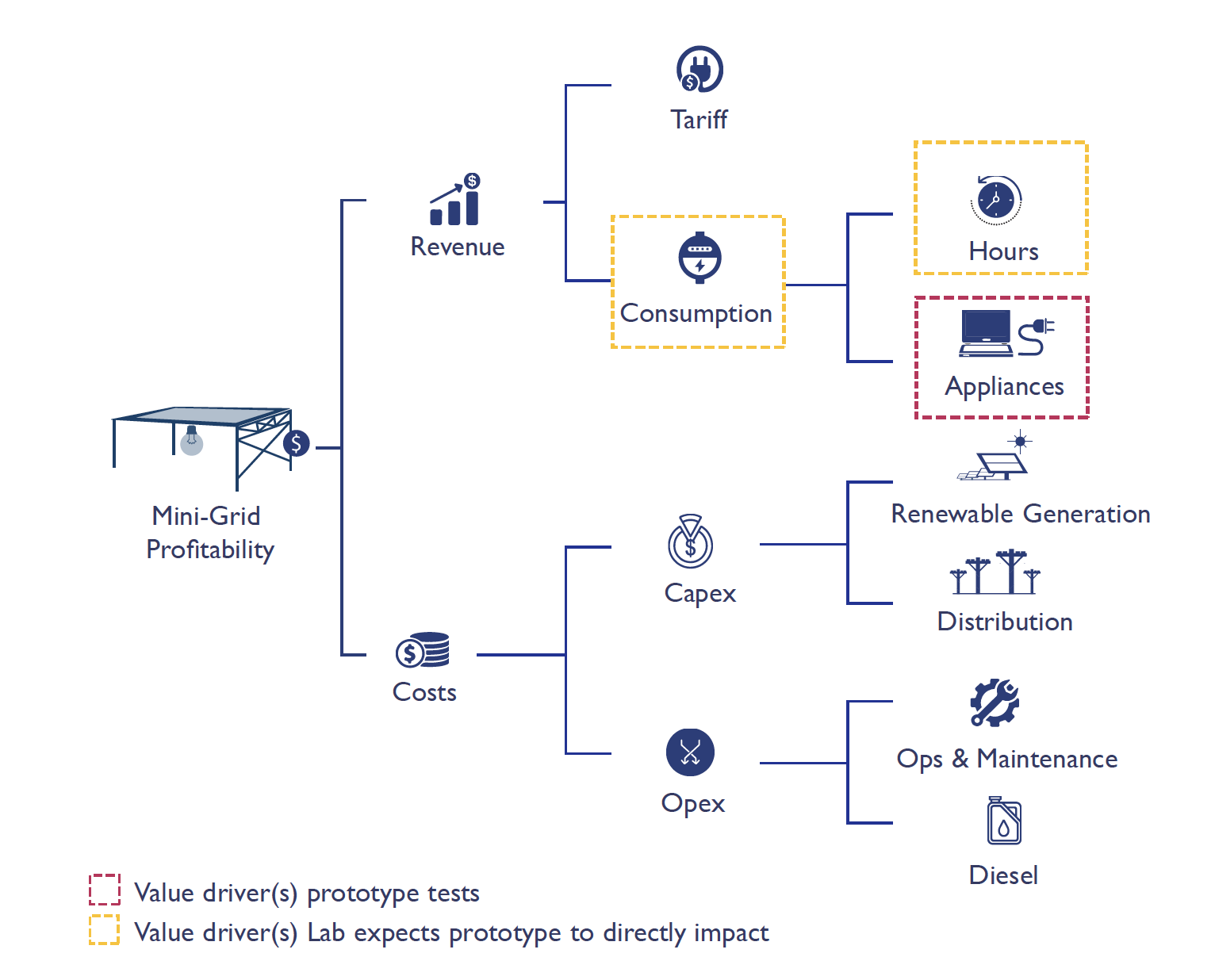

One of the fundamental challenges to the profitability of mini-grids is that rural customers’ energy consumption is typically too low. If customers don’t use sufficient electricity, there is not enough revenue for mini-grid developers to sustainably operate their grids. Customers’ electricity consumption is limited by both how much they can afford and what they can do with electricity. For example, regardless of their energy budget, customers who own a single 5 W LED lightbulb can only use mini-grid electricity for lighting. This means they can consume no more than 1 kWh per month, even if they run the lightbulb 6 hours a night, every night. This is problematic for both customers and mini-grid developers. Customers are missing out on the full benefits of electricity, while their low consumption of electricity decreases the profitability of the mini-grid.

So why don’t customers buy more appliances and use more power? One reason is that the upfront cost of appliances such as TVs and fridges is often too high for rural mini-grid customers. Offering appliances on credit, which has historically been an important part of efforts to drive demand in the US and Europe, may help overcome this barrier by breaking up the high upfront cost into more manageable monthly payments. To help developers determine whether appliance financing can profitably drive revenue and improve the mini-grid business model, the Innovation Lab is running an Appliance Financing prototype.

In 2018, the Lab supported seven mini-grid developers to sell 663 appliances on credit across 27 sites1 in East Africa and Nigeria, the largest trial of appliance financing on mini-grids in Africa to date. Early results suggest rural mini-grid customers are ready to use more power than their current means to put electricity to use allow – appliance purchasers consumed nearly twice as much electricity for the first five months following appliance delivery, in both regions.

Average revenue per user (ARPU) across all customers (not just those who purchased appliances) also saw considerable increases sustained over time. In East Africa, revenues are 18% above baseline levels after 11 months; in Nigeria, that number is 25% after 5 months.

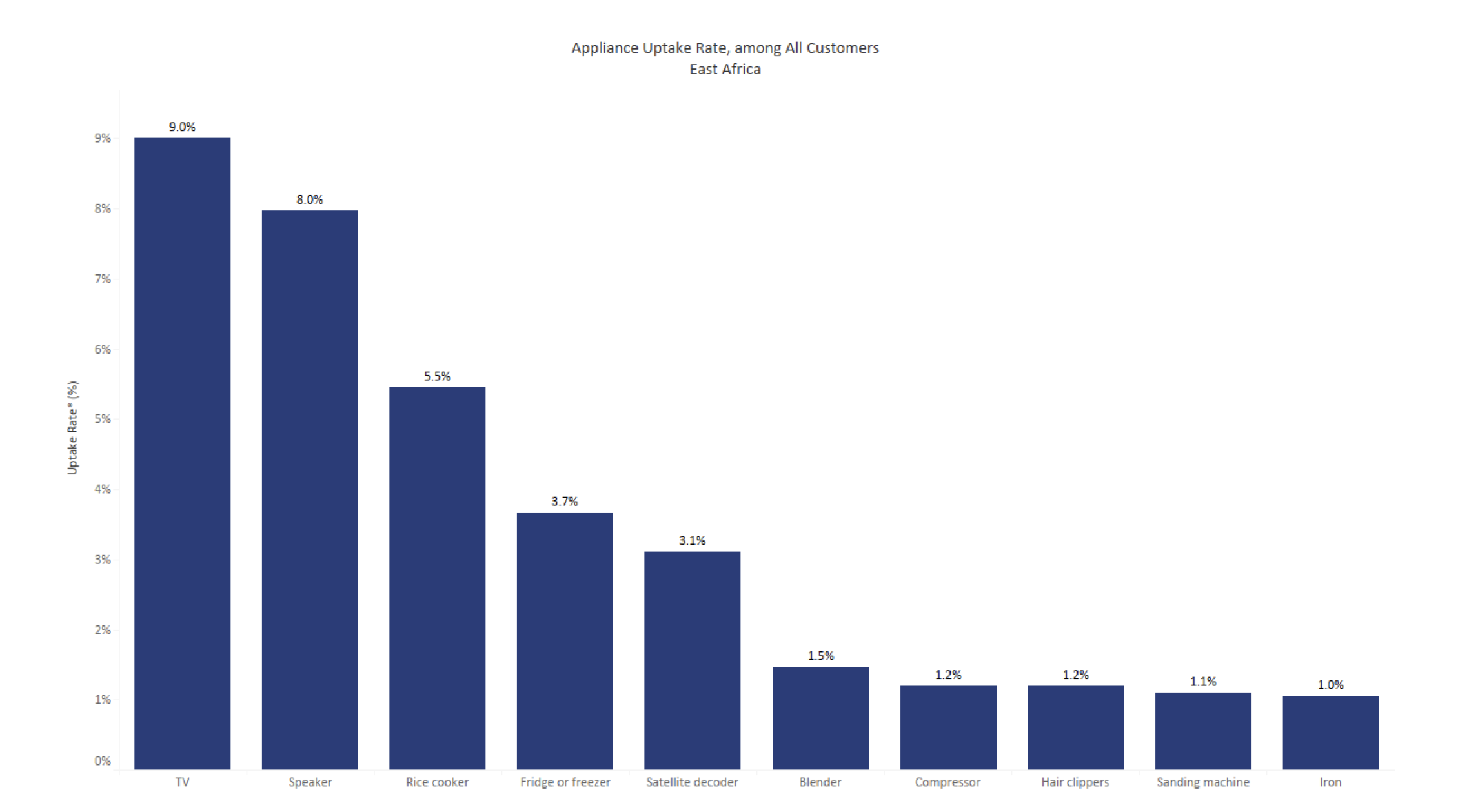

Of a range of household and productive use appliances, the most popular appliances were used for entertainment. Speakers2 and TV sales made up 393 of the total 663 appliances sold.

We can make four principal observations at this stage of the prototype:

- Offering appliances on credit has an immediate and strong effect on rural customers’ consumption. Rural customers are use- and credit-constrained.

- Mini-grid developers can raise revenues by implementing appliance financing schemes.

- Procuring appliances, distributing appliances, and tracking loan repayments is operationally complex and requires significant developer resources.

- Rural customers principally purchased household appliances. Productive use appliances such as carpentry tools were offered but very few customers purchased any.