Innovation Lab

Report

29.04.2021

Report

29.04.2021

Report

Appliance Financing 1.0 Innovation Insight – CrossBoundary Innovation Lab

Key Insights

Household appliances did not significantly increase mini-grid revenues, finds Crossboundary's Innovation Lab

The Lab has moved its focus to scaling financing programs for income generating machinery

CrossBoundary's Innovation Lab tests innovations to improve the mini-grid business model, and shares evidence with developers, governments, and funders so they can act

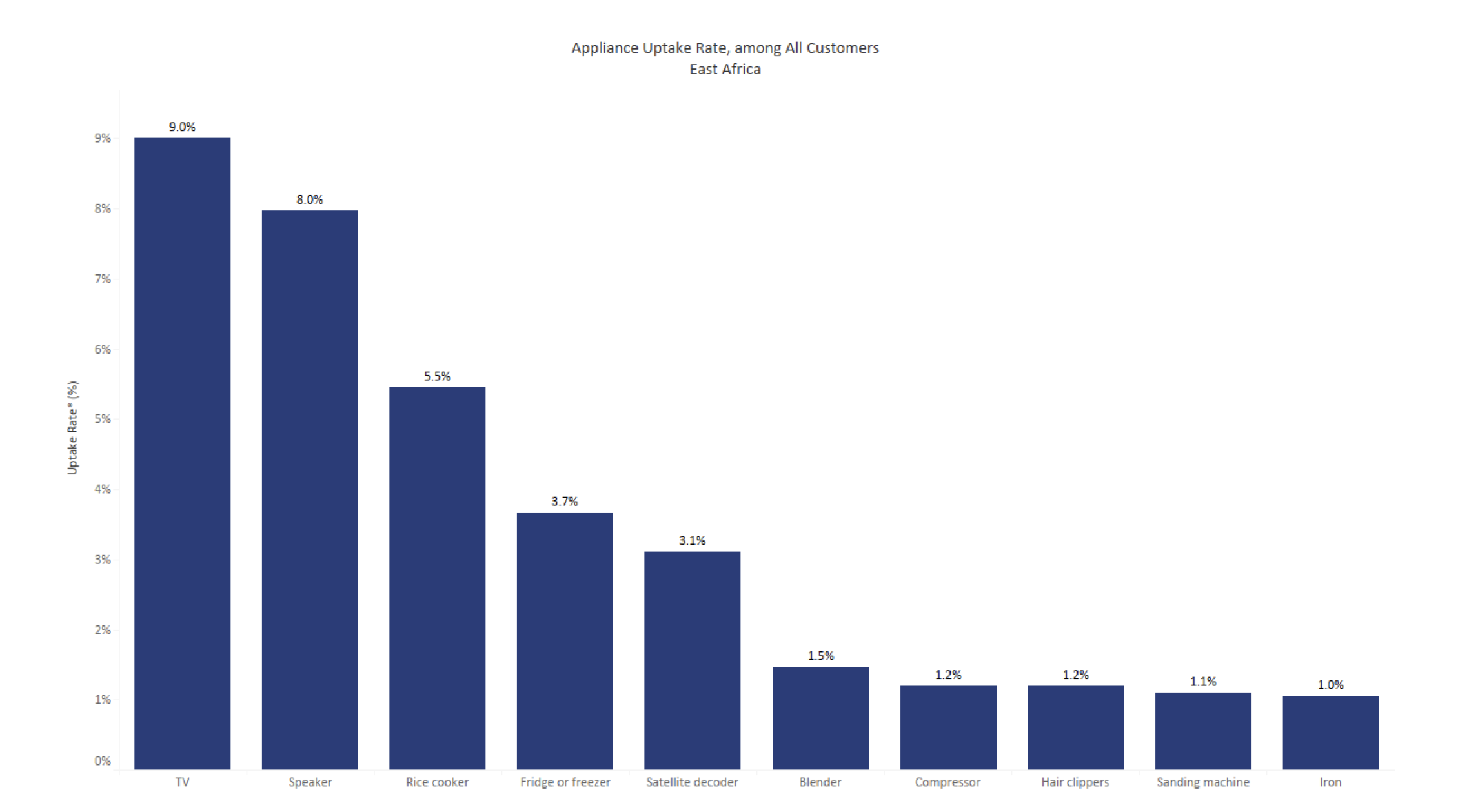

In our first Appliance Financing Innovation Insight, published in August 2019, we reported results 11 months after selling 663 appliances on credit in East Africa and Nigeria.

We found that rural customers are use-and credit-constrained, and are ready to consume more power given access to appliances:

- Offering appliances on credit has an immediate and strong effect on rural customers’ consumption, with median monthly consumption among all customers increasing by up to 52% in the first five months following appliance delivery.

- Mini-grid developers can raise revenues by implementing appliance financing schemes –revenues rose by 18% in East Africa, and 25% in Nigeria.

- Rural customers principally purchased household appliances and as a result there was no significant shift to daytime consumption.

This Innovation Insight brings more data to develop these findings, incorporating:

- 13 more months of hourly consumption and revenue data

- 67 more appliances

- New analysis on loan repayment for appliance suppliers and financiers to act on

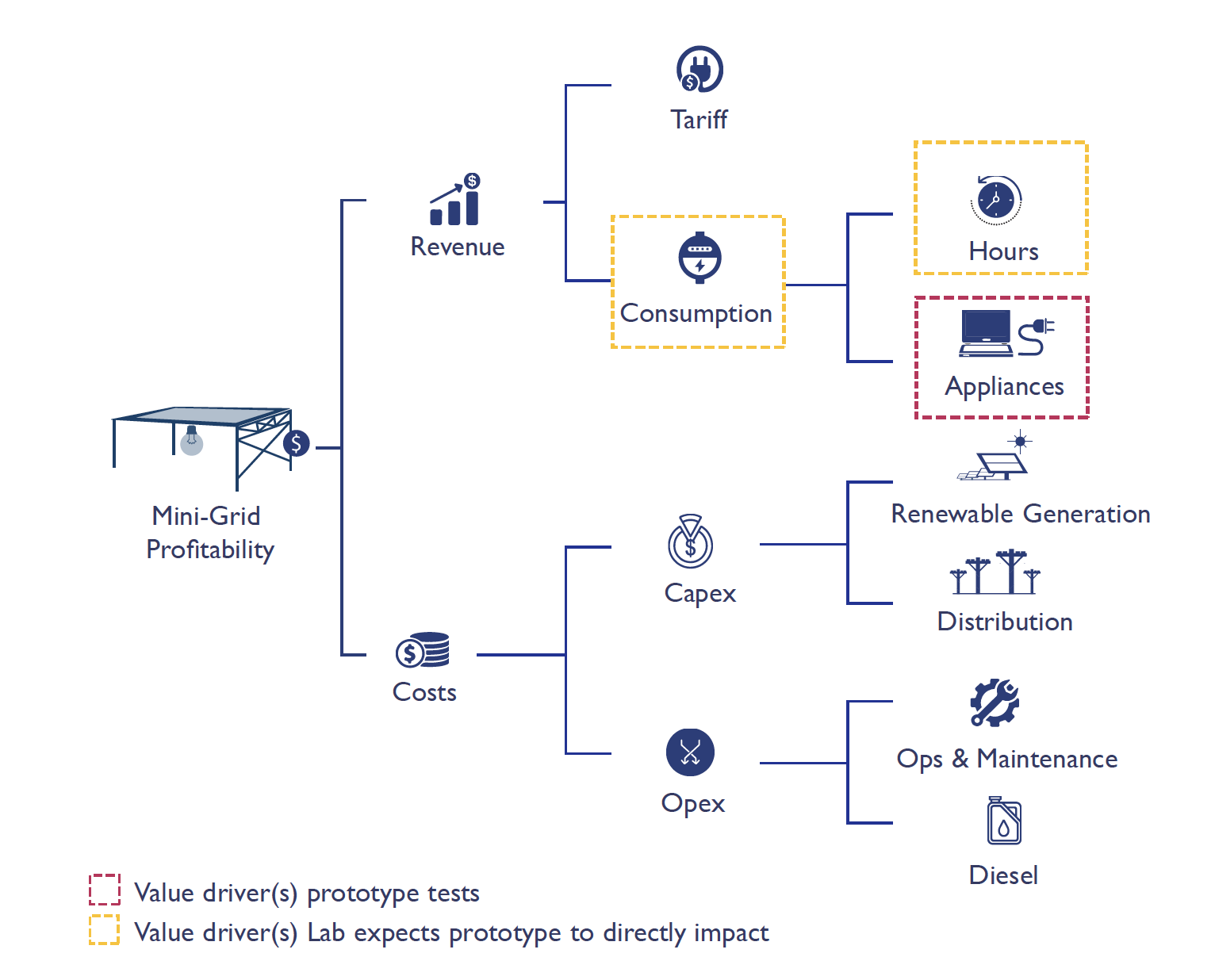

Appliances are a major driver of how much energy customers consume, and how much revenue developers earn.

The Lab expects offering customers appliances on credit will increase electricity consumption, both because customers can use energy in new ways, and they have a reason to use energy for longer.