Business Valuation Support for Pan-African Medical Equipment Distributor

Sub-Saharan Africa

About the Client

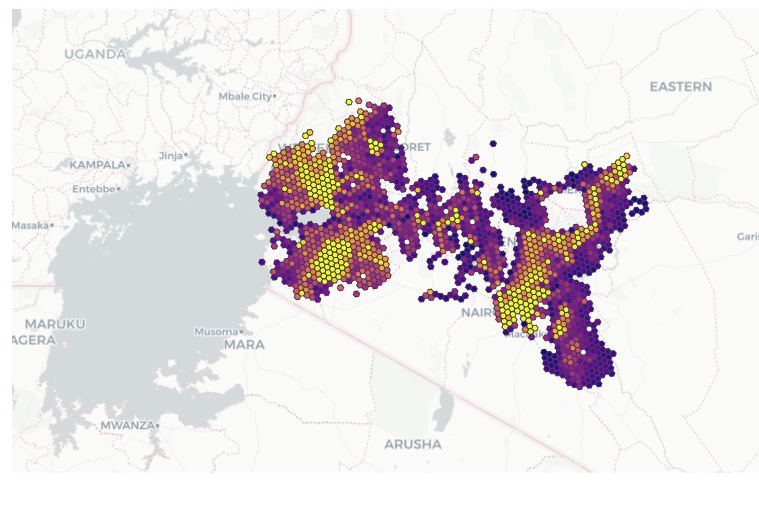

The Client is a leading distributor of specialist medical equipment and health products in approximately 15 countries in Sub-Saharan Africa. Operating in a rapidly growing healthcare market, the Client provides invaluable resources to healthcare institutions in regions where such equipment is scarce but critically needed.

Engagement

CrossBoundary Advisory was brought on board to critically assess an investment proposal by the International Finance Corporation (IFC) and LeapFrog Investments (LeapFrog), aimed to fund both an expansion into new markets within Sub-Saharan Africa and fulfill the Client’s working capital requirements.

Given the burgeoning healthcare sector in Africa, expected to reach approximately $150 billion by 2030, the funding could potentially capitalize on a significant market opportunity. Our involvement played a crucial role in helping the client navigate the complexities of the deal, balancing the interests of multiple stakeholders, and ensuring that the proposed investment was aligned with both short-term working capital needs and long-term strategic expansion objectives. This engagement was executed through USAID’s East Africa Trade & Investment Hub.

Approach

CrossBoundary Advisory took a multi-pronged approach to ensure the client received the best possible advice and support in navigating this significant investment:

Financial Analysis: Conducted in-depth financial analysis to perform a comprehensive business valuation of the company, taking into account both historical performance and projected growth within the sub-Saharan healthcare market.

Term Sheet Guidance: Provided expert advice in understanding and responding to the signed term sheet from IFC and LeapFrog, with a focus on key issues like equity financing, partnership structures, and valuation metrics.

Exit Strategy: Assisted in the development of a robust exit strategy that aligns with the Client’s long-term objectives, ensuring that the investment not only fuels immediate growth but is also strategically sound in the longer term.

The aim was to ensure that the Client was well-positioned to capitalize on this investment opportunity.