Opportunity Validation and Valuation Support for Nigerian and Kenyan Healthtech

Sub-Saharan Africa

About the Client

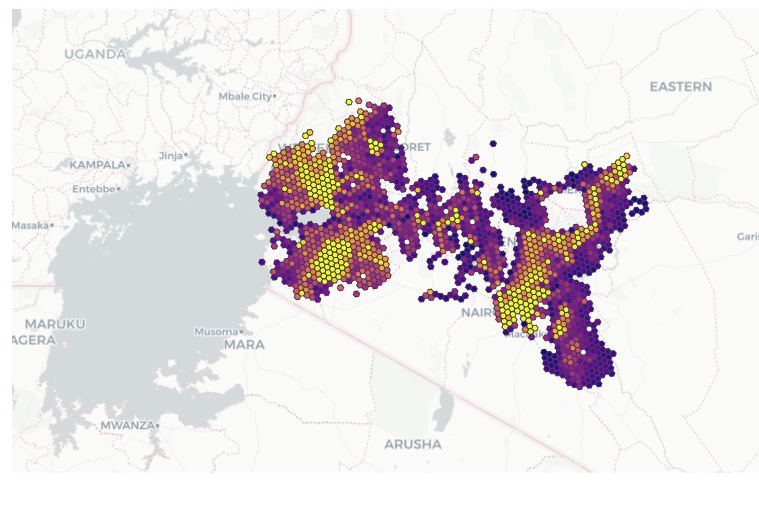

Field Intelligence is a healthcare technology company specializing in turnkey supply chain management, optimization, fulfillment, and financing solutions. Operating as both a technology provider and a licensed pharmaceutical distributor in Nigeria and Kenya, Field Intelligence serves over 36,000 care service points and has enabled more than 300 million pharmaceutical interventions across over 60 therapeutic areas to date.

Engagement

CrossBoundary Advisory was engaged by Field Intelligence to facilitate their Series A capital raise, aiming to expand the company’s groundbreaking healthcare technology solutions in Nigeria and Kenya. The engagement involved a rigorous top-down and bottom-up market opportunity assessment, refining the financial projections, and conducting a valuation analysis to provide a comprehensive investment package for potential investors. This engagement was executed through Prosper Africa.

Approach

In line with CrossBoundary Advisory’s commitment to providing high-impact investment advisory support, our approach was multi-dimensional and focused on rigorously validating the business case for Field Intelligence’s Series A capital raise:

Market Opportunity Assessment: Conducted both top-down and bottom-up market analyses to assess the size and potential for pharmaceutical and non-pharmaceutical distribution in Nigeria and Kenya. This provided investors with a more comfortable understanding of the market opportunity.

Financial Projections: Refined Field Intelligence’s financial projections to align with the market opportunity analysis. This helped to substantiate the business plan and investment case outlined to potential investors.

Valuation Analysis: Performed a thorough valuation analysis of Field Intelligence to validate the investment size and ownership estimates. This involved comparisons with similar entities in the healthcare technology sector and established valuation benchmarks to gain buy-in from high-priority investors.

This structured approach not only validated Field Intelligence’s business model but also built a strong case for investment, thereby facilitating a successful Series A capital raise.