Fundraising Support for a Leading Agtech in West Africa

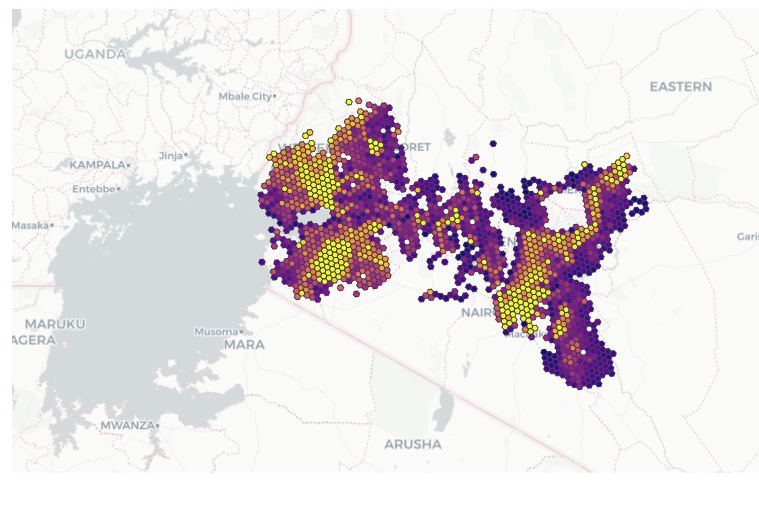

Sub-Saharan Africa

About the Client

Farmerline is a Ghanaian Agtech company that operates in Ghana, Cote d’Ivoire, and Togo. The company provides a range of products and services to its network of farmers, including 1) fertilizer, 2) software service for companies to trace and optimize their supply chain, and 3) market access to facilitate access to market for farmers.

Engagement

CrossBoundary Advisory was chosen as the trusted transaction advisor by Farmerline for its $12.9 million Pre-Series A fundraising round. The primary objectives were to engage with equity investors and introduce them to debt investors. The agricultural sector is a vital component of West Africa’s economy, but it faces numerous challenges including access to markets, supply chain inefficiencies, and insufficient funding. Agtech solutions like Farmerline are game-changers in addressing these issues, thereby making them attractive investment opportunities.