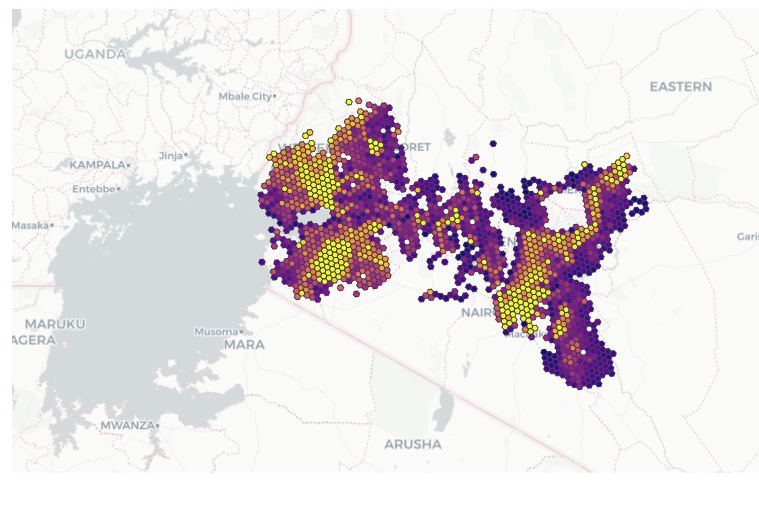

Investment and Market Strategy for Revitalizing the Kenyan Pyrethrum Sub-sector

Sub-Saharan Africa

About the Client

Kentegra Biotech Holdings is a U.S. company focused on a timely opportunity to produce pyrethrum pale refined extract, an active ingredient from the chrysanthemum flower, for home biocide, agricultural and pharmaceutical pesticide markets, thereby providing low to no toxic pesticides for organic farming. The company is keen on tapping into Kenya’s growing market for organic farming solutions, which is estimated to be worth over $40 million.

Engagement

CrossBoundary Advisory worked with Kentegra Biotech Holdings to optimize the quality of investor-related documentation, evaluate the company’s worth from an investment standpoint, and assist in forging relationships with potential investors. The client was particularly focused on three core questions:

- How can the existing fundraising materials be improved for a more effective fundraising strategy?

- What types of investors are most likely to invest in the project, and how can the company be effectively marketed to them?

- What is the probable valuation range that equity investors might assign to the company?

This engagement was executed through USAID’s Kenya Investment Mechanism.

Approach

To provide Kentegra Biotech Holdings with specialized, targeted support, CrossBoundary Advisory implemented an extensive suite of methods to polish investor materials, offer a balanced perspective on valuation, and streamline investor engagement. Specifically:

- We reviewed and refined key investor-related documents such as investment teasers, business plans, and pitch decks, using insights gained from prior fundraising initiatives and investor preferences.

- Created a preliminary valuation model to lay the groundwork for upcoming equity fundraising rounds.

- Advised on appropriate investment structures, terms, and covenants, aligning them closely with the company’s overall strategy.

- Identified and facilitated introductions to investors who are most likely to be interested in Kentegra’s unique value proposition.